Stakeholder capitalism advisory focuses on aligning business strategies with the interests of employees, customers, communities, and investors to create long-term value and sustainable impact. Corporate governance consulting emphasizes optimizing board structures, compliance frameworks, and risk management to enhance accountability and shareholder trust. Discover how these advisory services can transform your organization's strategic approach and governance practices.

Why it is important

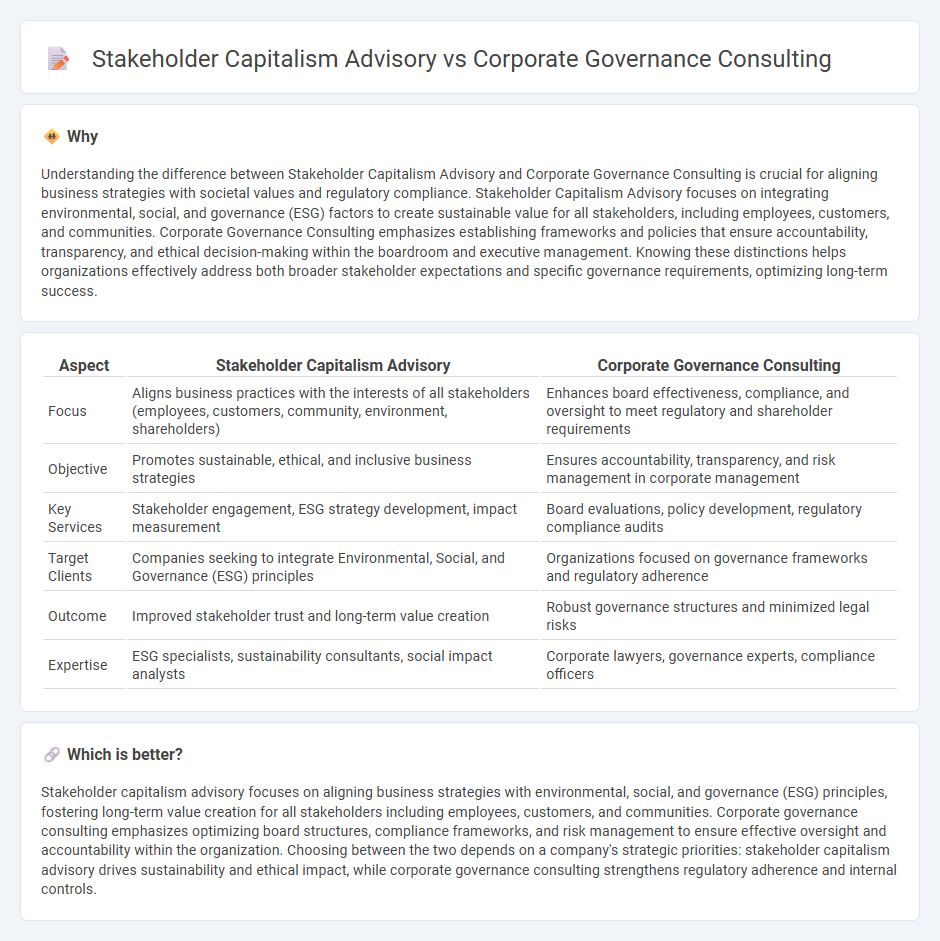

Understanding the difference between Stakeholder Capitalism Advisory and Corporate Governance Consulting is crucial for aligning business strategies with societal values and regulatory compliance. Stakeholder Capitalism Advisory focuses on integrating environmental, social, and governance (ESG) factors to create sustainable value for all stakeholders, including employees, customers, and communities. Corporate Governance Consulting emphasizes establishing frameworks and policies that ensure accountability, transparency, and ethical decision-making within the boardroom and executive management. Knowing these distinctions helps organizations effectively address both broader stakeholder expectations and specific governance requirements, optimizing long-term success.

Comparison Table

| Aspect | Stakeholder Capitalism Advisory | Corporate Governance Consulting |

|---|---|---|

| Focus | Aligns business practices with the interests of all stakeholders (employees, customers, community, environment, shareholders) | Enhances board effectiveness, compliance, and oversight to meet regulatory and shareholder requirements |

| Objective | Promotes sustainable, ethical, and inclusive business strategies | Ensures accountability, transparency, and risk management in corporate management |

| Key Services | Stakeholder engagement, ESG strategy development, impact measurement | Board evaluations, policy development, regulatory compliance audits |

| Target Clients | Companies seeking to integrate Environmental, Social, and Governance (ESG) principles | Organizations focused on governance frameworks and regulatory adherence |

| Outcome | Improved stakeholder trust and long-term value creation | Robust governance structures and minimized legal risks |

| Expertise | ESG specialists, sustainability consultants, social impact analysts | Corporate lawyers, governance experts, compliance officers |

Which is better?

Stakeholder capitalism advisory focuses on aligning business strategies with environmental, social, and governance (ESG) principles, fostering long-term value creation for all stakeholders including employees, customers, and communities. Corporate governance consulting emphasizes optimizing board structures, compliance frameworks, and risk management to ensure effective oversight and accountability within the organization. Choosing between the two depends on a company's strategic priorities: stakeholder capitalism advisory drives sustainability and ethical impact, while corporate governance consulting strengthens regulatory adherence and internal controls.

Connection

Stakeholder capitalism advisory and corporate governance consulting are interconnected by focusing on aligning business strategies with the interests of all stakeholders, including shareholders, employees, customers, and communities. Effective corporate governance frameworks support stakeholder capitalism by promoting transparency, accountability, and ethical decision-making within organizations. This integration enhances long-term value creation and sustainable business practices.

Key Terms

**Corporate governance consulting:**

Corporate governance consulting specializes in enhancing a company's board structures, compliance frameworks, and risk management processes to ensure transparency and accountability. This consulting service targets executive teams, board members, and regulatory bodies seeking to optimize decision-making standards and align with corporate policies. Explore our expertise in corporate governance consulting to strengthen your organization's leadership and regulatory adherence.

Board effectiveness

Corporate governance consulting prioritizes enhancing Board effectiveness through strategic oversight, risk management, and regulatory compliance to drive long-term shareholder value. Stakeholder capitalism advisory expands this focus by integrating social, environmental, and governance (ESG) criteria to balance the interests of diverse stakeholders while fostering sustainable business practices. Explore how aligning these approaches can optimize Board performance and stakeholder engagement for comprehensive corporate success.

Risk management

Corporate governance consulting emphasizes structured frameworks, compliance, and accountability to mitigate risks related to regulatory breaches, fraud, and operational failures. Stakeholder capitalism advisory broadens risk management by incorporating social, environmental, and governance (ESG) factors, ensuring sustainable value creation for diverse stakeholders beyond shareholders. Explore how integrating these approaches can enhance your organization's resilience and long-term success.

Source and External Links

Corporate Governance Consulting - SIS International - Helps organizations develop and implement effective governance structures, ensuring compliance, transparency, and alignment with best practices and strategic objectives.

Corporate Governance Services - NMS Consulting - Provides expert assessment and redesign of board composition, executive compensation, and governance processes to enhance transparency, accountability, and investor confidence.

Corporate Governance Consulting & Solutions | EQ - Equiniti - Offers targeted investor communications, vote projections, and governance advisory to help companies proactively manage shareholder engagement and proxy voting outcomes.

dowidth.com

dowidth.com