Carbon accounting advisory focuses on quantifying and managing greenhouse gas emissions to support regulatory compliance and sustainability goals. Climate risk assessment evaluates potential impacts of climate change on business operations, financial health, and supply chains to enhance resilience. Explore how integrating both services can optimize your organization's climate strategy and drive informed decision-making.

Why it is important

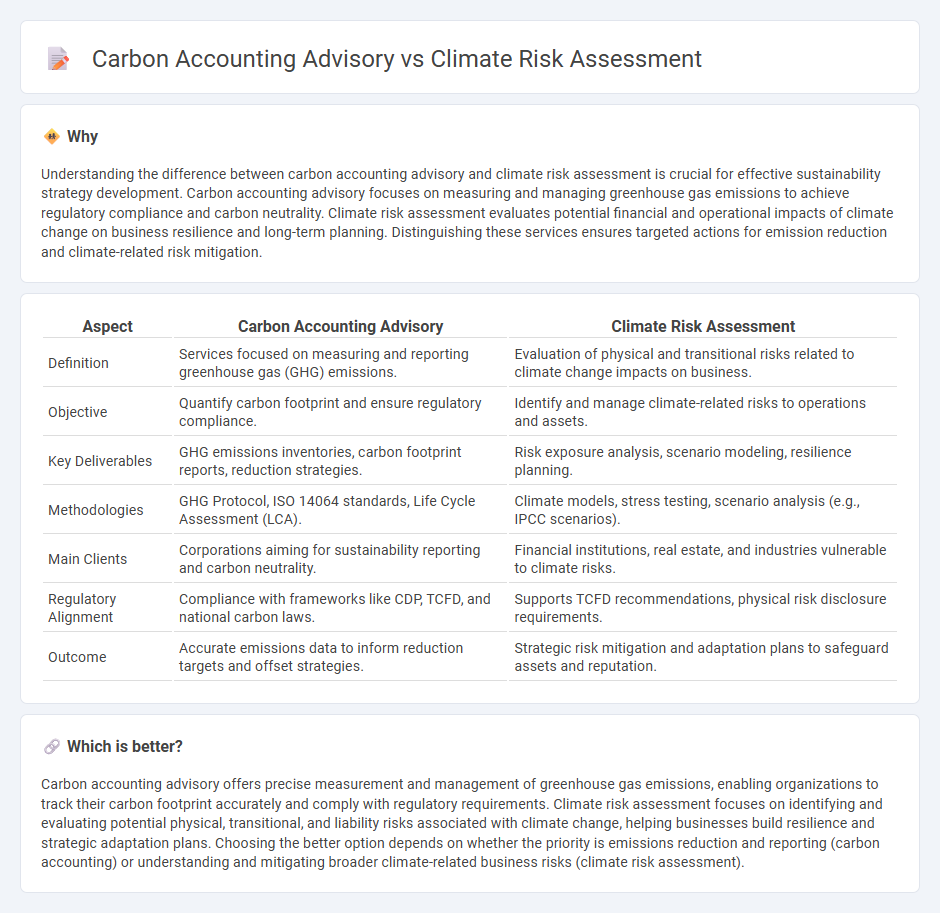

Understanding the difference between carbon accounting advisory and climate risk assessment is crucial for effective sustainability strategy development. Carbon accounting advisory focuses on measuring and managing greenhouse gas emissions to achieve regulatory compliance and carbon neutrality. Climate risk assessment evaluates potential financial and operational impacts of climate change on business resilience and long-term planning. Distinguishing these services ensures targeted actions for emission reduction and climate-related risk mitigation.

Comparison Table

| Aspect | Carbon Accounting Advisory | Climate Risk Assessment |

|---|---|---|

| Definition | Services focused on measuring and reporting greenhouse gas (GHG) emissions. | Evaluation of physical and transitional risks related to climate change impacts on business. |

| Objective | Quantify carbon footprint and ensure regulatory compliance. | Identify and manage climate-related risks to operations and assets. |

| Key Deliverables | GHG emissions inventories, carbon footprint reports, reduction strategies. | Risk exposure analysis, scenario modeling, resilience planning. |

| Methodologies | GHG Protocol, ISO 14064 standards, Life Cycle Assessment (LCA). | Climate models, stress testing, scenario analysis (e.g., IPCC scenarios). |

| Main Clients | Corporations aiming for sustainability reporting and carbon neutrality. | Financial institutions, real estate, and industries vulnerable to climate risks. |

| Regulatory Alignment | Compliance with frameworks like CDP, TCFD, and national carbon laws. | Supports TCFD recommendations, physical risk disclosure requirements. |

| Outcome | Accurate emissions data to inform reduction targets and offset strategies. | Strategic risk mitigation and adaptation plans to safeguard assets and reputation. |

Which is better?

Carbon accounting advisory offers precise measurement and management of greenhouse gas emissions, enabling organizations to track their carbon footprint accurately and comply with regulatory requirements. Climate risk assessment focuses on identifying and evaluating potential physical, transitional, and liability risks associated with climate change, helping businesses build resilience and strategic adaptation plans. Choosing the better option depends on whether the priority is emissions reduction and reporting (carbon accounting) or understanding and mitigating broader climate-related business risks (climate risk assessment).

Connection

Carbon accounting advisory services provide accurate measurement and reporting of greenhouse gas emissions, forming the foundation for effective climate risk assessment. Climate risk assessment uses this detailed emissions data to evaluate potential financial, regulatory, and operational risks linked to climate change. Together, they enable businesses to develop resilient strategies and comply with evolving environmental regulations.

Key Terms

Scenario Analysis

Scenario analysis plays a pivotal role in climate risk assessment by evaluating potential future climate impacts under varied conditions, helping organizations anticipate vulnerabilities and adapt strategies accordingly. Carbon accounting advisory emphasizes accurate measurement and reporting of greenhouse gas emissions to meet regulatory requirements and drive emission reduction goals. Explore in-depth how scenario analysis integrates within these frameworks to enhance strategic climate resilience.

Emissions Inventory

Emissions inventory serves as a foundational element in both climate risk assessment and carbon accounting advisory by systematically quantifying greenhouse gas outputs across scopes 1, 2, and 3. Climate risk assessment leverages emissions data to evaluate exposure to regulatory, physical, and transitional risks, enabling strategic adaptation and resilience planning. Explore how integrating detailed emissions inventories enhances sustainability strategies and compliance frameworks.

Transition Risk

Transition risk in climate risk assessment evaluates the financial impacts of shifting to a low-carbon economy, including policy changes, market dynamics, and technological advancements. Carbon accounting advisory focuses on measuring and managing greenhouse gas emissions, providing data essential for regulatory compliance and strategic decision-making related to carbon reduction. Explore our expert services to better understand how transition risk can impact your organization's sustainability strategy.

Source and External Links

Climate Risk Assessment & Management - Adaptation Community - Climate risk assessment identifies the nature and extent of climate change impacts by analyzing vulnerability, exposure, and hazards to support decision-making and adaptation planning across sectors and scales.

Technical guidance on comprehensive risk assessment and planning in the context of climate change - UNDRR - This guidance emphasizes the complexity and systemic nature of climate risks and provides a framework for comprehensive risk assessment and planning to improve climate risk governance and policy response.

European Climate Risk Assessment - The EU's first comprehensive climate risk assessment identifies 36 critical risks to energy, food security, ecosystems, infrastructure, and health, highlighting the urgent need for strategic policy actions in Europe.

dowidth.com

dowidth.com