Peer-to-peer payments enable direct money transfers between individuals using mobile apps or digital platforms, offering convenience and speed without the need for physical cards. Debit card payments involve transactions through bank-issued cards linked to checking accounts, providing widespread acceptance and secure processing. Explore more to understand which payment method suits your financial needs best.

Why it is important

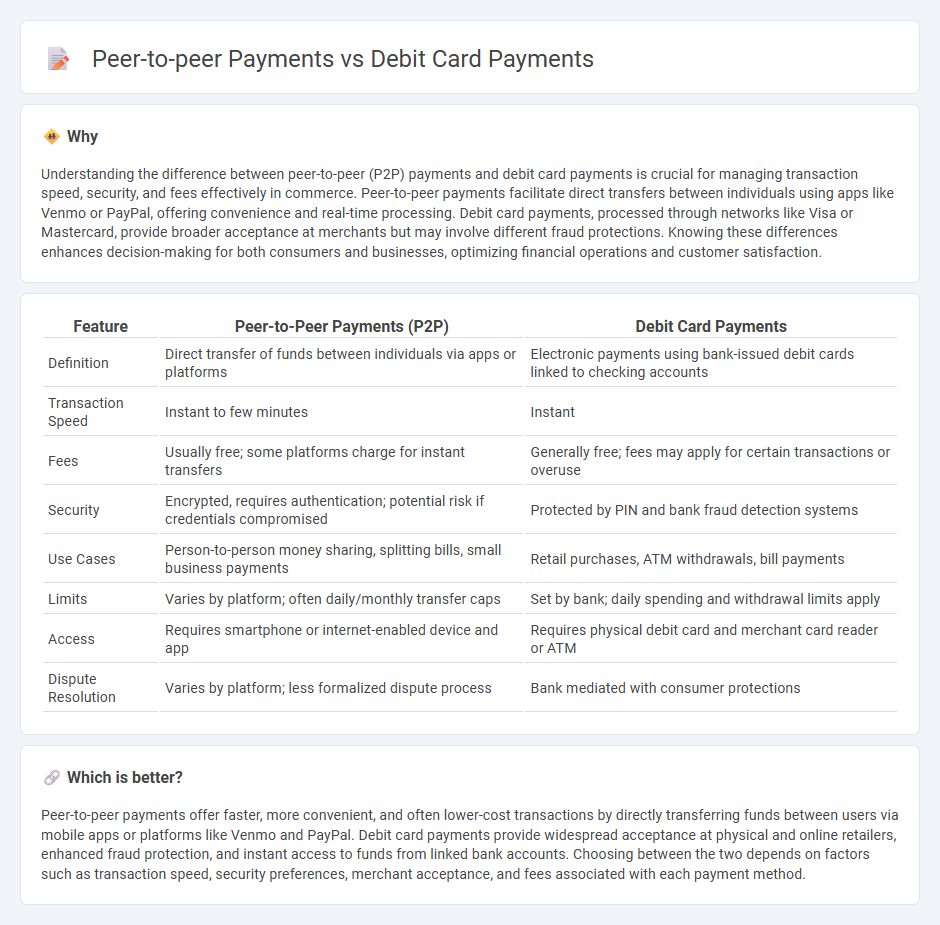

Understanding the difference between peer-to-peer (P2P) payments and debit card payments is crucial for managing transaction speed, security, and fees effectively in commerce. Peer-to-peer payments facilitate direct transfers between individuals using apps like Venmo or PayPal, offering convenience and real-time processing. Debit card payments, processed through networks like Visa or Mastercard, provide broader acceptance at merchants but may involve different fraud protections. Knowing these differences enhances decision-making for both consumers and businesses, optimizing financial operations and customer satisfaction.

Comparison Table

| Feature | Peer-to-Peer Payments (P2P) | Debit Card Payments |

|---|---|---|

| Definition | Direct transfer of funds between individuals via apps or platforms | Electronic payments using bank-issued debit cards linked to checking accounts |

| Transaction Speed | Instant to few minutes | Instant |

| Fees | Usually free; some platforms charge for instant transfers | Generally free; fees may apply for certain transactions or overuse |

| Security | Encrypted, requires authentication; potential risk if credentials compromised | Protected by PIN and bank fraud detection systems |

| Use Cases | Person-to-person money sharing, splitting bills, small business payments | Retail purchases, ATM withdrawals, bill payments |

| Limits | Varies by platform; often daily/monthly transfer caps | Set by bank; daily spending and withdrawal limits apply |

| Access | Requires smartphone or internet-enabled device and app | Requires physical debit card and merchant card reader or ATM |

| Dispute Resolution | Varies by platform; less formalized dispute process | Bank mediated with consumer protections |

Which is better?

Peer-to-peer payments offer faster, more convenient, and often lower-cost transactions by directly transferring funds between users via mobile apps or platforms like Venmo and PayPal. Debit card payments provide widespread acceptance at physical and online retailers, enhanced fraud protection, and instant access to funds from linked bank accounts. Choosing between the two depends on factors such as transaction speed, security preferences, merchant acceptance, and fees associated with each payment method.

Connection

Peer-to-peer (P2P) payments and debit card payments are connected through their use of linked bank accounts and electronic funds transfer networks. P2P platforms often require users to link debit cards to facilitate instant transfers and enhance transaction security. Both payment methods leverage the Automated Clearing House (ACH) and card networks like Visa or Mastercard to enable seamless, real-time fund transfers.

Key Terms

Intermediary

Debit card payments typically involve intermediaries such as banks and payment processors that facilitate the transaction by verifying funds and authorizing payments. Peer-to-peer (P2P) payments often reduce or eliminate these intermediaries by enabling direct transfers between users through digital platforms or mobile apps, increasing transaction speed and lowering costs. Explore further to understand how intermediary roles impact security and efficiency in both payment methods.

Settlement

Debit card payments settle through traditional banking networks such as Visa or MasterCard, typically requiring 1-3 business days for full reconciliation and fund transfer. Peer-to-peer payments, processed via platforms like PayPal or Venmo, often enable instant or near-instant settlement, leveraging real-time payment rails and digital wallets. Explore the nuances of settlement speed, security, and accessibility in these payment methods to optimize transaction efficiency.

Transaction authorization

Debit card payments rely on issuer authorization involving real-time verification of cardholder identity and available funds through payment networks like Visa or Mastercard. Peer-to-peer payments use mobile or online platforms that authenticate users via credentials and biometric data, enabling direct fund transfers without traditional intermediaries. Explore the nuances of transaction authorization methods to understand their impact on security and convenience.

Source and External Links

How do debit card payments work? - Stripe - A debit card payment involves authorization, card network routing, bank balance checking, authorization response, and final clearing and settlement to move funds from the cardholder's bank to the merchant's account.

Using and paying with debit cards - MoneyHelper - Debit cards are linked to bank accounts allowing payments in shops, online, or cash withdrawals, typically authenticated by PIN or contactless methods, often usable from age 11 onward.

Credit vs Debit Card Online Payment Processing - Stax Payments - Debit card transactions online or in-store are authorized using either a PIN or a signature, and funds are withdrawn immediately when the PIN method is used, with the transaction clearing within 1-3 business days.

dowidth.com

dowidth.com