Peer-to-peer payments enable direct money transfers between individuals using digital platforms such as Venmo or PayPal, offering convenience and instant settlement. Cryptocurrency payments utilize decentralized digital currencies like Bitcoin or Ethereum, providing enhanced security and transparency through blockchain technology. Explore the differences in technology, usability, and market impact to understand which payment method suits your needs best.

Why it is important

Understanding the difference between peer-to-peer (P2P) payments and cryptocurrency payments is crucial for securing transactions and optimizing financial strategies in commerce. P2P payments typically involve transferring money between users via traditional banking systems or payment apps like PayPal and Venmo, ensuring regulatory compliance and ease of use. Cryptocurrency payments utilize blockchain technology, offering decentralized, borderless transactions with increased privacy and potential for value appreciation. Knowing these distinctions helps businesses select appropriate payment methods to minimize risks and enhance customer trust.

Comparison Table

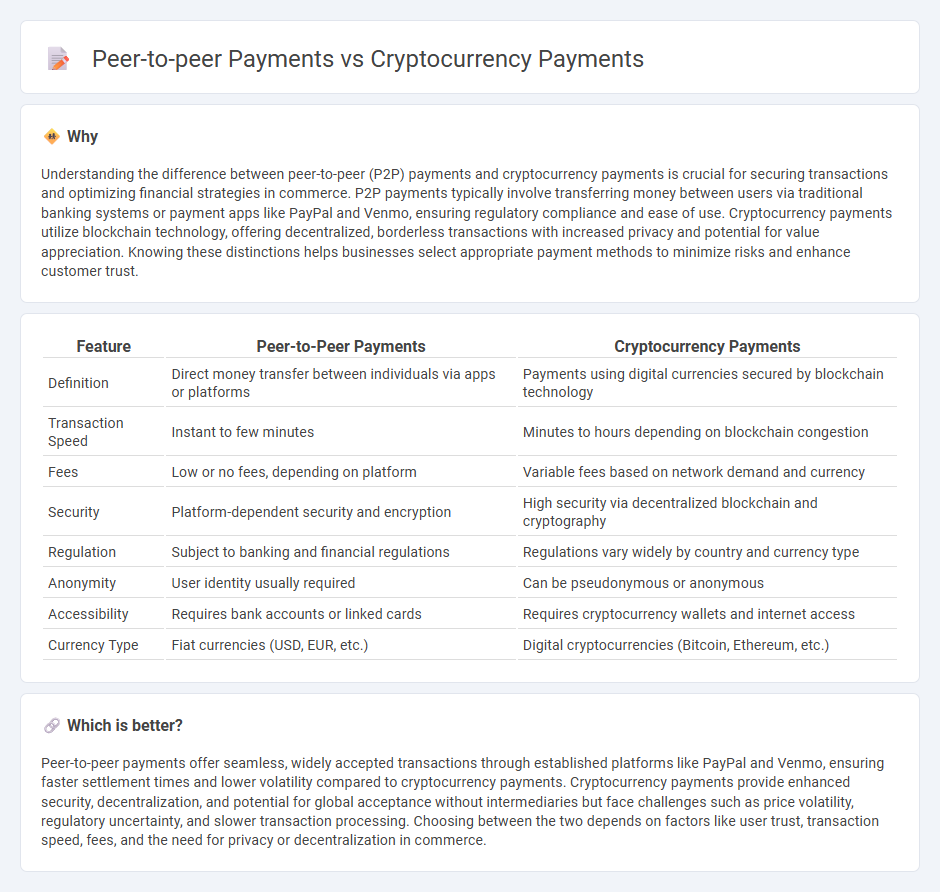

| Feature | Peer-to-Peer Payments | Cryptocurrency Payments |

|---|---|---|

| Definition | Direct money transfer between individuals via apps or platforms | Payments using digital currencies secured by blockchain technology |

| Transaction Speed | Instant to few minutes | Minutes to hours depending on blockchain congestion |

| Fees | Low or no fees, depending on platform | Variable fees based on network demand and currency |

| Security | Platform-dependent security and encryption | High security via decentralized blockchain and cryptography |

| Regulation | Subject to banking and financial regulations | Regulations vary widely by country and currency type |

| Anonymity | User identity usually required | Can be pseudonymous or anonymous |

| Accessibility | Requires bank accounts or linked cards | Requires cryptocurrency wallets and internet access |

| Currency Type | Fiat currencies (USD, EUR, etc.) | Digital cryptocurrencies (Bitcoin, Ethereum, etc.) |

Which is better?

Peer-to-peer payments offer seamless, widely accepted transactions through established platforms like PayPal and Venmo, ensuring faster settlement times and lower volatility compared to cryptocurrency payments. Cryptocurrency payments provide enhanced security, decentralization, and potential for global acceptance without intermediaries but face challenges such as price volatility, regulatory uncertainty, and slower transaction processing. Choosing between the two depends on factors like user trust, transaction speed, fees, and the need for privacy or decentralization in commerce.

Connection

Peer-to-peer payments and cryptocurrency payments are interconnected through blockchain technology, enabling direct transfers between users without intermediaries. Cryptocurrency payments use decentralized digital currencies like Bitcoin and Ethereum, which facilitate secure, fast, and transparent peer-to-peer transactions globally. The integration of peer-to-peer payment systems with cryptocurrency enhances financial inclusion and reduces transaction costs in commerce.

Key Terms

Blockchain

Cryptocurrency payments leverage blockchain technology to enable secure, transparent, and decentralized transactions without intermediaries, drastically reducing processing times and fees compared to traditional payment systems. Peer-to-peer payments, while also facilitating direct transfers between users, often depend on centralized platforms that can limit security and increase costs. Explore the advantages of blockchain-powered cryptocurrency payments to understand their transformative impact on digital finance.

Decentralization

Cryptocurrency payments operate on decentralized blockchain networks, eliminating intermediaries and enhancing transaction transparency and security. Peer-to-peer payments, while sometimes utilizing centralized platforms like Venmo or PayPal, rely on traditional banking systems that introduce third-party control and potential delays. Explore the impact of decentralization on transaction speed, cost, and privacy to understand the evolving landscape better.

Fiat currency

Cryptocurrency payments leverage blockchain technology to facilitate secure, decentralized transactions often characterized by lower fees and faster cross-border transfers compared to traditional fiat currency payments. Peer-to-peer payments using fiat currency typically rely on intermediaries like banks or payment processors, which can result in higher transaction costs and longer processing times. Explore in-depth comparisons of cryptocurrency and peer-to-peer fiat payments to understand their impact on transaction speed, cost-efficiency, and security.

Source and External Links

Best Crypto Payment Gateway & Processor | Accept Crypto Payments - CoinGate offers an easy-to-integrate crypto payment gateway allowing merchants to accept Bitcoin, stablecoins, and multiple cryptocurrencies, with instant crypto-to-fiat conversion and payouts directly to bank accounts.

Best Crypto Payment Gateways For Trading In 2025 - A detailed review and comparison of top crypto payment gateways like NOWPayments, BitPay, and CryptoPay, highlighting their fees, supported coins, and features such as API support and instant payouts for secure and flexible cryptocurrency payments.

A new standard in global crypto payments | Coinbase Commerce - Coinbase Commerce provides merchants with a seamless platform for accepting crypto payments globally, featuring instant settlement, volatility-free conversions to USDC, a low 1% fee, and integrations with popular e-commerce platforms for easy onboarding.

dowidth.com

dowidth.com