Distributed ledger marketplaces leverage blockchain technology to offer enhanced transparency, security, and decentralization, removing intermediaries and enabling peer-to-peer transactions. Centralized marketplaces rely on a single authority to manage operations, providing streamlined control and faster dispute resolution but posing risks related to data breaches and single points of failure. Discover more about how these marketplace models impact commerce innovation and user trust.

Why it is important

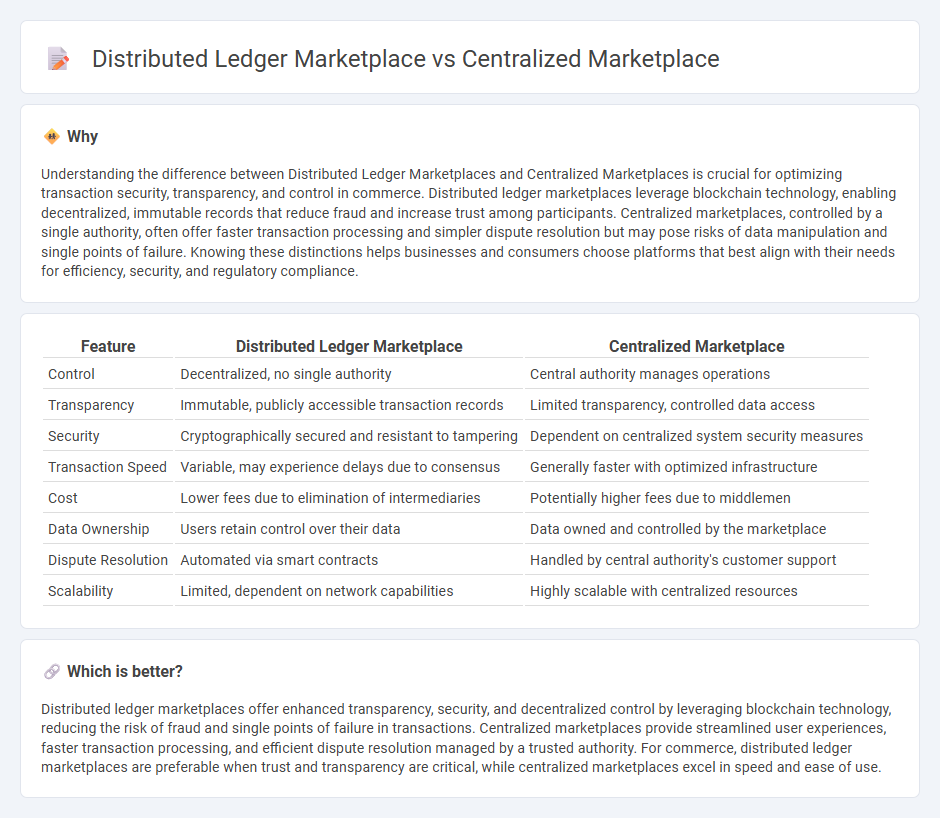

Understanding the difference between Distributed Ledger Marketplaces and Centralized Marketplaces is crucial for optimizing transaction security, transparency, and control in commerce. Distributed ledger marketplaces leverage blockchain technology, enabling decentralized, immutable records that reduce fraud and increase trust among participants. Centralized marketplaces, controlled by a single authority, often offer faster transaction processing and simpler dispute resolution but may pose risks of data manipulation and single points of failure. Knowing these distinctions helps businesses and consumers choose platforms that best align with their needs for efficiency, security, and regulatory compliance.

Comparison Table

| Feature | Distributed Ledger Marketplace | Centralized Marketplace |

|---|---|---|

| Control | Decentralized, no single authority | Central authority manages operations |

| Transparency | Immutable, publicly accessible transaction records | Limited transparency, controlled data access |

| Security | Cryptographically secured and resistant to tampering | Dependent on centralized system security measures |

| Transaction Speed | Variable, may experience delays due to consensus | Generally faster with optimized infrastructure |

| Cost | Lower fees due to elimination of intermediaries | Potentially higher fees due to middlemen |

| Data Ownership | Users retain control over their data | Data owned and controlled by the marketplace |

| Dispute Resolution | Automated via smart contracts | Handled by central authority's customer support |

| Scalability | Limited, dependent on network capabilities | Highly scalable with centralized resources |

Which is better?

Distributed ledger marketplaces offer enhanced transparency, security, and decentralized control by leveraging blockchain technology, reducing the risk of fraud and single points of failure in transactions. Centralized marketplaces provide streamlined user experiences, faster transaction processing, and efficient dispute resolution managed by a trusted authority. For commerce, distributed ledger marketplaces are preferable when trust and transparency are critical, while centralized marketplaces excel in speed and ease of use.

Connection

Distributed ledger marketplaces and centralized marketplaces are connected through their shared goal of facilitating secure and efficient transactions between buyers and sellers. Distributed ledger technology enhances transparency and trust by recording transactions on a decentralized blockchain, reducing the risk of fraud common in centralized systems that rely on a single authority. Integration of these marketplaces enables hybrid models, combining the scalability of centralized platforms with the security and immutability of distributed ledgers.

Key Terms

Intermediary

Centralized marketplaces rely heavily on intermediaries to facilitate transactions, enforce trust, and handle dispute resolution, adding layers of control and potential costs. Distributed ledger marketplaces eliminate traditional intermediaries by using blockchain technology for transparent, secure, and decentralized transaction validation, reducing fees and increasing efficiency. Explore the key differences and implications for businesses by learning more about intermediary roles in these marketplace models.

Transparency

Centralized marketplaces operate under a single controlling entity, limiting transparency as transaction data and decisions remain proprietary and often inaccessible to users. Distributed ledger marketplaces utilize blockchain technology, ensuring that transaction records are immutable, publicly verifiable, and decentralized, significantly enhancing transparency through consensus mechanisms. Explore how these differences impact trust and efficiency in digital commerce to understand the implications for your business or investments.

Decentralization

Centralized marketplaces operate on a single authority controlling data and transactions, leading to limited transparency and higher risk of censorship. Distributed ledger marketplaces utilize blockchain technology to enable decentralization, ensuring data immutability, increased security, and enhanced trust among participants. Explore deeper into how decentralization transforms marketplace dynamics and user empowerment.

Source and External Links

Centralized vs Decentralized Markets - Forex Education Center - A centralized marketplace operates through a single location or entity, controlled by a central authority that facilitates transactions and ensures transparency and regulation, unlike decentralized markets where transactions happen peer-to-peer without intermediaries.

Commerce Marketplace | Salsify - A centralized marketplace enables brands to sell products in a controlled environment where order processing, shipping, and customer service are managed, providing a unified platform to reach more consumers and take control over commerce operations.

Enterprise Data Marketplace: A Centralized Portal for All Your Data Assets - A centralized enterprise data marketplace provides a secure, unified portal for accessing and governing distributed data assets with centralized control, improving data visibility, security, and reuse across the organization.

dowidth.com

dowidth.com